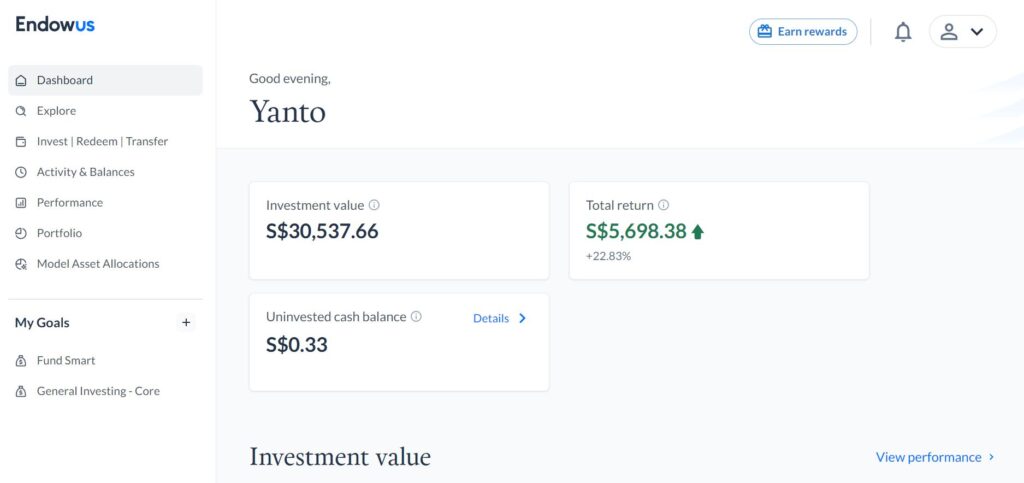

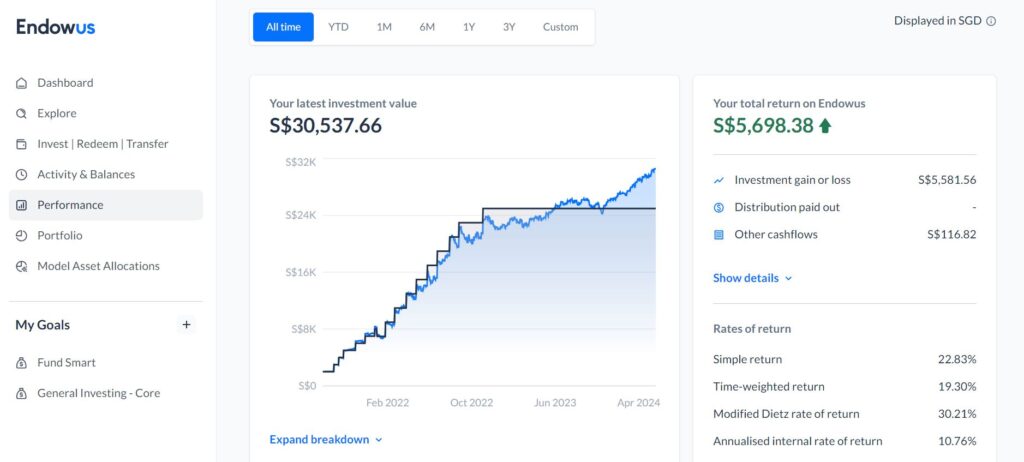

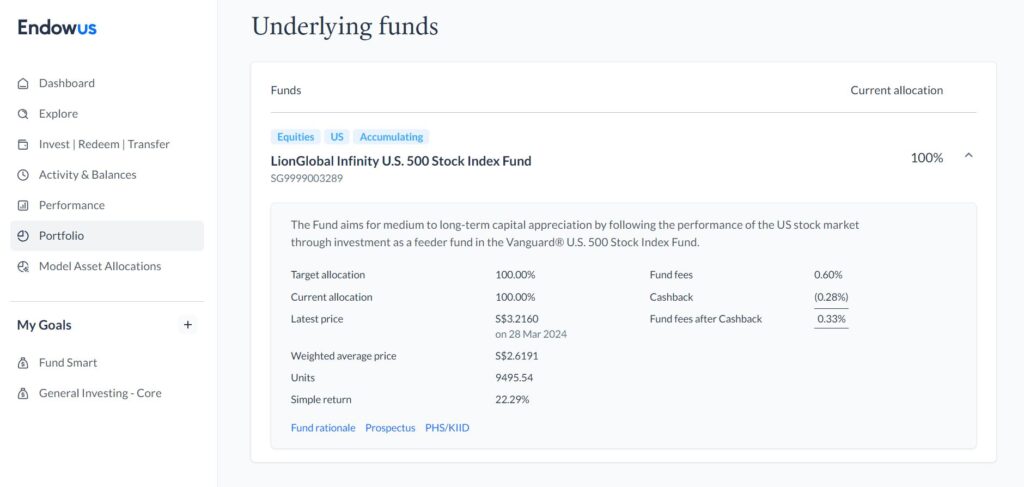

I am glad that I made the decision to invest SGD 25,000 of my CPF-OA into the Lion Global Infinity US 500 Stock Index Fund with Endowus during the inflation-induced market downturn in 2022/2023. The index fund portfolio is now worth more than SGD 30,000. That works out to be about SGD 5,000 of net profit after deducting all fees and expenses. As a layman, I’m quite happy with the return.

The good return reflects the performance of the S&P 500. The index has increased by 158.08 points (3.10%) in March 2024. The US economy continues to show resilience despite being in the high interest rate environment. Personally, I like to take a top-down approach when it comes to investing. I’m interested to know how the economy is performing. Let’s look at some of the numbers that we have up to March 2024.

Employment Report

Non-Farm Payrolls (NFP) for February 2024 was released on Friday, 8 March 2024. The US economy added 275k of jobs. For comparison, the economy added 229k in the previous month. While this figure indicates the job market is doing well, it may also indicate that the demand for workers is still higher than the available workers. This may cause a persistent wage inflation which in turn resulting in higher interest rate for a longer period of time.

I like to keep track of the unemployment rate as well. This is because should unemployment rate unexpectedly spikes up, this may be a sign that the Fed will proceed to cut the interest rate earlier. Based on the data released in March 2024, the unemployment rate has increased slightly from 3.7% in January 2024 to 3.9% in February 2024.

Inflation Data

For inflation data, the CPI for 12 months up to February 2024 came in at 3.2%. The CPI data has been hovering in the low range of 3% for a few months. This has obviously made some investors jittery. But, is the current inflation data a cause of concern? We found out the answer during the March 2024 FOMC Meeting.

FOMC Meeting

In FOMC March 2024 meeting, the Committee has decided to maintain the Fed funds rate at 5.25 to 5.5%. The question in investors’ mind now is when will the Fed begins to cut interest rates. For this, we may be able to get an idea of what the Fed is thinking through it’s quarterly Summary Economic Projections (SEP).

Based on the SEP, the Fed considers cutting the Fed funds rate to 4.5 to 4.75% throughout 2024. That means a decrease of 0.75% (75 basis points) from the current level of interest rates. In addition to that, the SEP also shows that the Fed expects the inflation as measured by core PCE to be at 2.6% in 2024, falling to 2.2% in 2025 and hitting the Fed’s target at 2.0% in 2026. In short, the Fed believes that the recent inflation data is still in line with their expectations.

GDP

When using a top-down investing approach, I also like to have an idea of how the US GDP is performing. After all, it is a measure of recession – which is defined as two consecutive months of negative GDP.

The quarterly GDP came in at 3.4%. This is higher than the previous quarter of 3.2%. This GDP data gives me a certain level of assurance that the US economy is growing.

Conclusion

I’m not an expert, but it appears to me that the fundamentals remain healthy. While the trajectory of S&P 500 index may not always follow the economic data, but these economic data give me some idea whether to buy, hold or sell my investment. You may have a very different conclusion, but personally I’m not looking to sell my investment in April 2024 unless there is something drastic that happens.

– Yanto Wong –