You may have realised that I have used an index fund as a starting point for the investment portfolio of this blog. Why didn’t I begin by buying the individual stocks instead? Let me share some of the reasons why I chose an index fund rather than individual stocks today.

For those who have just started following this personal finance blog, you may want to read the articles I have written in the past few weeks. I believe this will help you to understand better what I will be sharing this week.

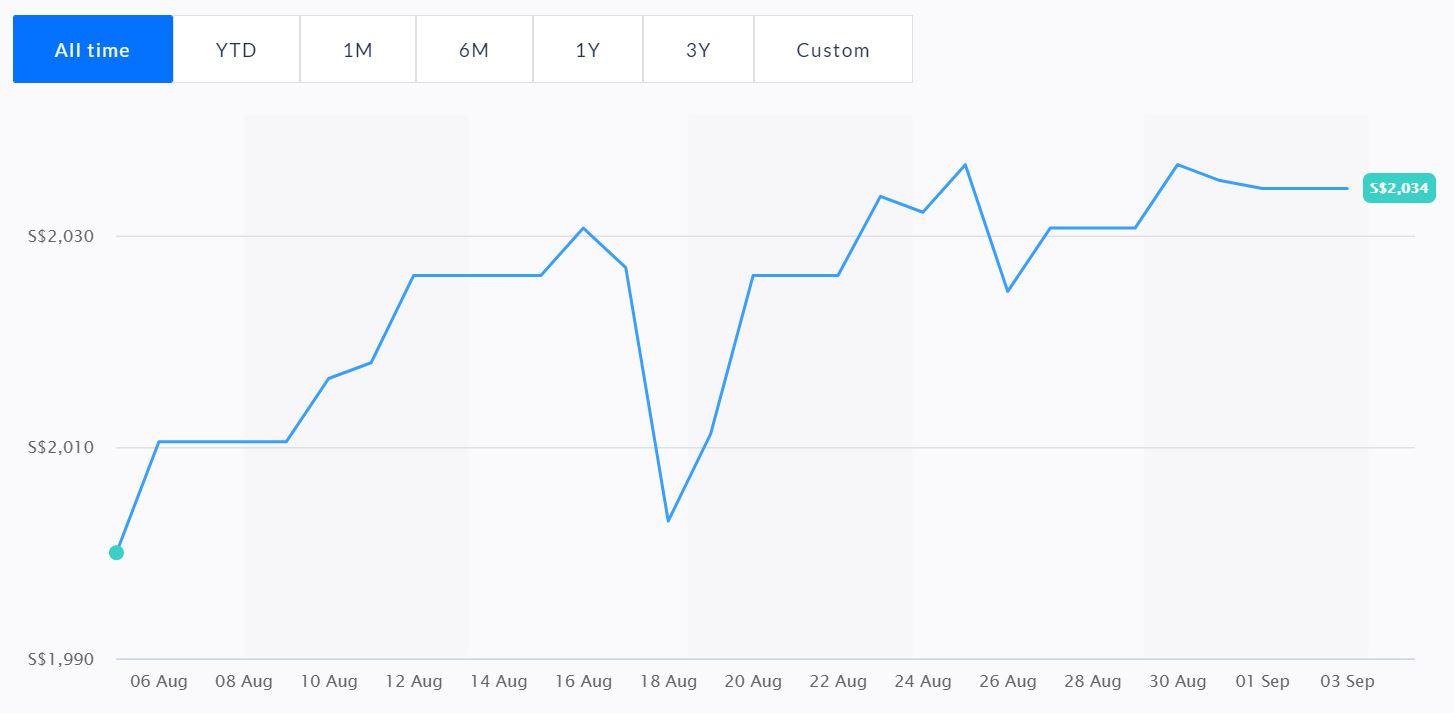

If you are wondering how the portfolio has been performing this week, here is the latest chart.

The best way to learn about investing is to observe how a real-life investment portfolio grows over time. It will also be the approach I will take in this personal finance blog. May all of us be a community of highly sophisticated investors one day – while making good money on the journey.

Index Fund vs Individual Stocks

As I expect many of you are new to the investment world, I will share the main two reasons and keep the explanations as simple as possible.

1. A community of new investors

Last week, we learnt about investment strategy. You can either adopt an active or passive investment strategy. For this blog, I have used a passive investment strategy. That means I invest in an index fund instead of individual stocks.

Why is that so?

The main reason is that I wish to customise this personal finance blog for those new to investing and with little or no prior knowledge. The passive investment strategy is significantly easier to learn and put into practice than the active investment strategy.

Yes, you may be able to earn higher rates of return through an active investment strategy. However, it also takes much more in-depth knowledge to ‘beat’ the market.

Therefore, let’s stick to passive investing for now. We can always move on to an active investment strategy when you are more comfortable with the financial markets.

2. Minimise the risk through diversification

I started investing 15 years ago. Each time I enter a new financial market, I will always enter small. Warren Buffett puts this nicely – Never test the depth of a river with both feet.

For new investors who are starting their investing journey, you should never go all out. The drawback when investing with a small amount of money is that it is difficult to diversify.

I started this portfolio with $2,000 from CPF-OA. With that amount, there aren’t many individual stocks I can buy. The portfolio will carry a higher risk than necessary due to the lack of diversification.

That is the second reason why I started with an index fund instead of individual stocks. I believe you should too.

30 October 2006 – The day I became a capitalist.

I bought my first stock on 30 October 2006. While it was not the best investment decision, I was correct that the best way to learn about investing is by entering the financial markets with real money.

Looking back on how I started investing helps me to understand what are the challenges of new investors. I hope by sharing how I build my CPF investment portfolio step by step, you will gain relevant knowledge and be more confident in investing.

I am where I am today because society has opened up the paths for me. This personal finance blog is my little contribution back to the community. At the same time, I do enjoy writing and sharing all things about money. I hope you have enjoyed my weekly articles. I promise I will continue posting every Friday, 6 pm. Do feel free to read it before your Friday night outing or during the weekend.

By the way, it’s Friday! Have fun, people! 🙂

Yanto Wong