In this Lion Global Infinity US 500 Review article, I will share my actual investment portfolio with Endowus. The last time I did the review this portfolio was in November 2021. I guess it is due for another look now. As you may already know, I use the CPF-OA fund for this portfolio.

Please note that this article does not provide any financial advice. It is for educational and entertainment purposes only. Please consult your financial adviser concerning your circumstances.

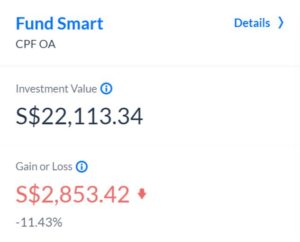

Investment Value

I started investing in Lion Global Infinity US 500 Stock Index Fund in August 2021 with an initial amount of SGD 2,000. After the initial investment, I manually contributed SGD 1,000 monthly from September 2021 to January 2022. I increased the monthly contribution to SGD 2,000 from February 2022 to September 2022. The total investment up to September 2022 is SGD 23,000.

I decided to stop the monthly contribution at this point. This portfolio tends to be more experimental. It was the first time I applied the monthly dollar cost averaging (DCA) strategy. DCA strategy has a wide following among new investors due to the perception that they do not need to monitor the financial markets. But is that really how investing should be?

Why did I decide to “time” my entry now?

Let’s be clear here. I believe no one knows for sure where the market will go. However, if you monitor the market, you will have some idea of when is the time NOT to invest.

There were many economic and other issues in 2022.

Inflation was climbing, and the Fed was aggressively increasing the interest rates. The higher borrowing cost will hit the profit of companies. In turn, this will lower the valuation of the stocks. The market sentiment was weak. The best thing to do was to sit on the sideline and do nothing!

Inflation was not the only issue investors were concerned about in 2022. There was a conflict in Ukraine, a supply chain issue in China, and crypto crashes.

Investment Portfolio Update

I added another SGD 2,000 in November 2022. The total investment in Lion Global Infinity US 500 Stock Index Fund is now SGD 25,000.

My Endowus investment portfolio is now down by 11.43%.

What would I do next?

Nothing.

I will do nothing most of the time. But I will continue to monitor the market. Should S&P 500 crash badly, I will be looking to buy more units in Lion Global Infinity US 500 fund.

Invest safe

The market is volatile now. Please be careful. I have not seen such a market condition since 2008. While many investors are shying away from the market, I believe this is a once-in-a-decade opportunity to acquire fundamentally strong assets at much lower prices.

I hope you find this Lion Global Infinity US 500 Review article beneficial. Stay safe!

– Yanto Wong –